|

Quantify Benefits

|

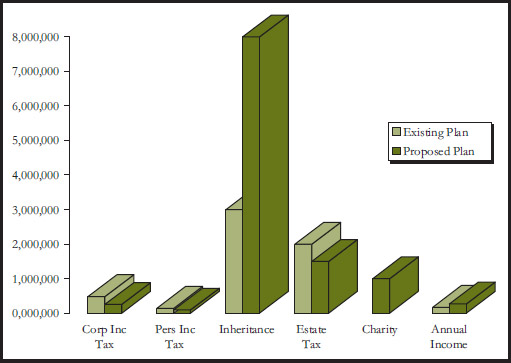

At the culmination of Phase 1,

Family Offi ce Services prepares a Value

Proposition Letter that quantifi es the

benefi ts of planning before you

engage us, and determines your cost

of moving forward in the planning

process.

Drawing upon our experience

in developing hundreds of plans

for wealthy individuals, we are

able to show you specifi cally how

proper planning will lower

your estate and income taxes,

increase transfers to your

heirs, improve lifetime income,

enhance your charitable giving

potential, and achieve other

goals. You will see how tax

savings typically exceed our

fees by a factor of 200 to 1.

The Value Proposition Letter:

- Summarizes results of

current plan.

- Estimates potential

benefi ts of planning.

- Recommends a course of

action.

- Estimates

fees.

|

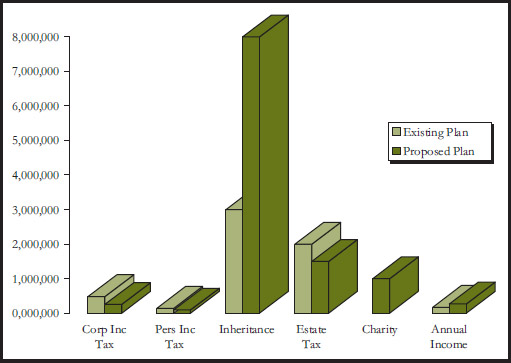

| |

| Value Proposition Letter Grid |

| |

Existing Plan |

Proposed

Plan |

| Current Year Corporate Income Tax |

$480,000 |

$255,000 |

| Current Year Personal Income Tax |

$140,000 |

$95,000 |

| Inheritance to Heirs |

$ 3,000,000 |

$ 8,000,000 |

| Estate Tax |

$ 2,000,000 |

$ 1,500,000 |

| Legacy to Charity |

$ 0 |

$ 1,000,000 |

| Projected After-Tax Retirement Income |

$ 170,000 |

$ 267,000 |

| Business Goes to Children |

No |

Yes |

|

| |

Proposed plan Summary |

| Reduced Corporate Income Taxes |

$ 225,000

for 10 years |

| Reduced Personal Income Taxes |

$87,000

over 2-6 years |

| Increased Annual After-Tax Personal Income Pre-Retirement |

$ 30,000 |

| Increased Annual After-Tax Retirement Income |

$ 88,000 |

| Eliminated Capital Gains Taxes on Sale of Business |

$ 750,000 |

| Reduced Estate Taxes |

$ 500,000 |

| Increased Net to Heirs |

$ 5,000,000 |

| Increased to Charity |

$ 1,000,000 |

|

|

|

|